How to Choose a Payment Provider For Your Startup

Are you wondering how to choose the best payment provider for your startup? In this article, we will delve into the details of payment gateway integrations and what startups need to know before integrating them into their platforms.

In today’s digital age, businesses are increasingly turning to cashless payment systems that offer speed, convenience, and security to their customers. With the rise of eCommerce, digital and mobile wallets have become the most popular payment method, accounting for 49% of total eCommerce expenditure worldwide in 2021. As a result, any business that wants to monetize online must offer a reliable payment system to cater to this growing segment of customers.

This is where a payment gateway comes into play. A payment gateway is an essential tool for businesses that process online payments. It acts as a middleman between a customer’s bank account and a merchant’s bank account, facilitating secure and speedy transactions. A payment gateway determines the fees, checkout methods, and currencies that can be accepted, making it an integral part of any eCommerce platform.

In this post, we will explain the workings of a payment gateway, including the role of a merchant account, and the various security measures and encryptions put in place to ensure the safety of transaction data. By the end of this article, you will have a better understanding of how payment gateways can benefit your startup and how to choose the right one for your needs.

What is a Payment Provider For a Startup?A payment gateway is a crucial component of any e-commerce website that enables businesses to accept online payments from their customers. It acts as an intermediary between the merchant’s website and the customer’s payment method, such as credit card, debit card, or e-wallet.

When a customer makes a payment on the merchant’s website, the payment gateway securely transfers the payment information from the customer to the merchant’s bank account, ensuring that the transaction is processed smoothly and quickly. To ensure that the transaction data remains safe, payment gateways use various security measures and encryptions.

Payment gateways can perform several types of transactions, including authorization, capture, sale, refund, and void. Authorization transactions are used to check if the customer has sufficient funds in their account to pay for the goods or services. Capture transactions are processed once the payment is authorized, resulting in the transfer of funds. Sale transactions are a combination of authorization and capture, where the cardholder is authorized, and the money may or may not be captured. Refund transactions occur when an order is canceled, and the business has to refund the customer’s account. Void transactions are similar to refunds, but they happen when the funds are not captured.

Overall, payment gateways play a critical role in facilitating secure online payments and helping businesses increase revenue by providing customers with a convenient and easy payment experience. Understanding the different types of payment gateway transactions is important for businesses to choose the right payment gateway and ensure seamless payment processing.

Forecasting the Online Payment Market For Startups in 2027

The concept of cashless payments has been around for centuries, dating back to the second half of the 12th century when Italian merchants utilized notes called “Lettres de foire” for transactions instead of coins or precious metals. The reason behind this innovation was primarily for security and logistic purposes, as transporting a cart full of coins and precious metal was not only cumbersome but also attracted unwanted attention. Fast forward to the 21st century, and the idea of cashless payments has evolved, driven by advancements in technology and financial exchange methods.

In today’s world, cashless payment methods are gaining traction, with over 80% of purchases in the United States being made through non-cash methods in 2022. Furthermore, the global market for online payments is expected to witness an annual growth rate (CAGR 2022-2027) of 12.31%, reaching a projected total value of US$15.17tn by 2027. It’s worth noting that, in 2021, more than half of all e-commerce transactions globally were made using mobile and digital wallets, a figure projected to increase to over 53% by 2025.

The growth of cashless payment methods is driven by several factors, including the need for increased security, convenience, and ease of use. Additionally, cashless payments have proven to be an effective solution for reducing the loss of revenue incurred by businesses due to late payments. As more businesses transition towards digitization, online payment gateways have become an essential tool for facilitating the flow of funds between customers and merchants. The popularity of these payment gateways is due to their ability to provide fast, secure, and reliable payment options for customers, while also streamlining payment processes for businesses.

How Online Payments are Processed

The online payment processing infrastructure is a complex and intricate system that operates beyond the checkout page and bank app notifications that customers typically see. While these components represent the visible face of the process, there are multiple back-end procedures, institutions, tools, and verifications involved in ensuring successful purchase completion.

For startups venturing into the online payment space, it is crucial to have a sound understanding of the complexities involved.

How the Payment Processing Happens

The payment processing sequence is as follows, occurring within a few seconds of the customer pressing the purchase button:

- Customer: Clicks on the “Purchase” button and enters payment details, which are encrypted and sent to the merchant’s web server through an SSL connection.

- Merchant and Payment Gateway: Merchant sends received data to the payment gateway through an encrypted SSL channel, where tokens are stored instead of credit card numbers for security reasons. Any stored data is kept in secure storage.

- Payment Processor: Data is sent from the payment gateway to payment processors, third-party companies that provide payment processing services. They transfer information between the payment gateway and the merchant’s account. The payment processor sends the transaction to the card network (e.g., Mastercard, Visa).

- Card Network: The card network verifies transaction data and sends it to the bank that issued the customer’s credit/debit card.

- Issuer Bank: The customer’s bank approves or denies the authorization request, and a unique code containing transaction status or error details is sent back to the payment processor by the customer’s bank.

- Payment Gateway: The transaction status is then sent back to the payment gateway, which is then transferred to the website.

- Customer and Issuing Bank: The purchaser receives a notification from the bank about the transaction status through the app or SMS.

- Issuer Bank: It takes about two days for the customer’s bank to transfer the funds to the merchant’s bank.

Ready to Turn Your Statup Idea Into App?

Contact Us

Online payment gateways come in multiple types and have unique functionalities. Each type requires a different approach to integration. Here are some of the most common types of payment gateway integrations:

Hosted Payment Gateway

When a customer clicks on the purchase button, they are redirected to the payment gateway provider’s website to complete the payment. All sensitive data storage and transaction processing are done at the provider’s end, making it fast and easy to provide digital payments without direct integration. However, the business has no control over the payment gateway.

Direct Post Payment Gateway

Here, the business uses a third-party payment gateway, but customers are not redirected to another site to complete the payment. Instead, payment and customer data are sent from the website’s back-end to the payment gateway’s server for processing and storage. This method provides a faster and more user-friendly checkout, but the business is limited in customizing payment options and checkout experiences.

Self-Hosted White-Label Payment Gateway

This white-label payment gateway solution can be bought ready-made and integrated into the business’s website using APIs. The checkout process occurs with the website, and there are no redirects. It provides businesses with much control over processing and storing customer-sensitive information and payment data. However, it requires strict compliance with PCI DSS and can be time-consuming and costly to integrate with older apps.

Non-Hosted Custom Payment Gateway

This payment gateway solution is built from scratch specifically for the business’s needs and integrated directly into the website or app using custom APIs. The checkout process occurs within the app, giving the business complete control over the payment and seamless integration with legacy systems. However, building from scratch is time-consuming and requires lots of resources, and the business is responsible for maintaining and supporting the payment processing infrastructure.

Read Related

Choosing the right payment gateway provider is a critical decision for your business. Conducting research beforehand is essential to avoid making the wrong choice. Here are some factors to consider before finalizing your decision:

Familiarize Yourself With the Pricing

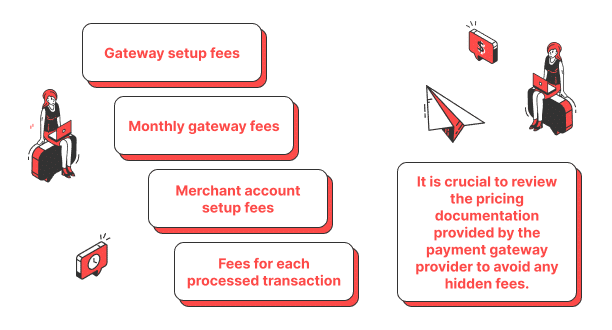

Payment processing involves various financial institutions, making it a complicated process. Payment gateway providers charge a fee to process and authorize transactions, and each institution involved in the process also requires a fee. Therefore, these fees can become significant. Transactions are usually billed based on factors such as transaction amount, product or service type, and location.

Different providers have various pricing models, including the following types of fees:

- Gateway setup fees

- Monthly gateway fees

- Merchant account setup fees

- Fees for each processed transaction

- It is crucial to review the pricing documentation provided by the payment gateway provider to avoid any hidden fees.

Check the Provider’s Transaction Limits

While fees and installation charges are inevitable, other financial aspects also play a critical role in selecting a gateway provider. Transaction limits are one such factor. Gateway providers typically have minimum and maximum transaction amounts, and merchants need to consider both values based on the products or services they offer.

For instance, choosing Stripe with a minimum transaction amount of $0.50 is not ideal for businesses selling products for less than that amount, as it can significantly impact sales.

Review Merchant Account Options

A merchant account is a necessary account that businesses must open to process transactions in the acquiring bank while adhering to credit card processing regulations. Payment gateway providers and banks offering this service can help merchants set up these accounts. Therefore, it is advisable to select a payment gateway provider that offers a merchant account if you already have one.

Ensure the Gateway Supports Necessary Payment Methods For Your Target Market

Choosing a payment gateway provider that supports as many payment methods as possible is essential. Mobile wallets have become the most popular payment method, followed by credit/debit cards. Additionally, it is crucial to verify that the provider supports all required credit card networks to avoid payment rejections.

Multi-currency support is another essential aspect, especially for businesses operating globally, as customers may use their local currencies for purchases. Therefore, payment gateway providers should offer this option, with or without additional fees.

Consider Mobile Payments

Mobile payments, such as Apple Pay and Google Pay, are becoming increasingly popular, and payment gateway providers must support them. These payment methods receive funds from credit/debit card accounts and have their tokenization process to protect sensitive client data.

Ensure Your Product Type is Acceptable to the Payment Vendor

Most providers accept two types of products: physical and digital. However, some providers may only work with one product type. Therefore, merchants selling physical and digital products should avoid such providers.

Payment gateways are becoming increasingly popular, with hundreds of options available in the market. Here are the top and most reliable ones:

PayPal

PayPal is a well-known and established payment gateway provider that offers a simple setup process, making it popular for businesses, particularly those just starting. According to PayPal, businesses that use their service experience a 44% increase in checkout conversion rates. It accepts credit/debit cards worldwide and supports over 200 countries and 25 different currencies. However, PayPal’s pricing model for international transactions, micropayments, and platform usage is complex and needs different calculations. The fees may range from $1.90 to $3.49, with an additional $0.49 transaction fee for domestic transactions. For international commercial transactions, the fee is 1.50% of the total amount.

Amazon Pay

Amazon Pay offers quick and simple payments, thanks to the Amazon online marketplace. It provides a one-click checkout process that customers enjoy, as millions of individuals already have an Amazon account. Amazon Pay is a fantastic option for merchants who want to customize their payment gateway by interacting with their website’s API, enabling them to customize the payment step with their own logo. There are no monthly or setup fees, and the domestic transaction fees are set at 2.9% + $0.30 for each transaction, while international transactions are set at 3.9%.

Stripe

Stripe allows for extensive customization, making it ideal for businesses that want complete control over their website. It is easy to integrate with the website’s API, and e-commerce business owners can also combine it with their current ERP, invoicing, and shopping cart systems. Stripe supports payments in 150 currencies, making it an excellent choice for businesses with a worldwide audience. The integrated package charges 2.9% with an additional $0.30 per transaction, and there are no setup fees. Stripe also offers a customized package for large businesses.

Stripe provides many features to simplify recurring billing for startups. With Stripe’s subscription management, automated payments, invoicing, payment retry, and dunning management features, startups can streamline their billing processes and focus on growing their business.

Stripe provides many features to simplify recurring billing for startups. With Stripe’s subscription management, automated payments, invoicing, payment retry, and dunning management features, startups can streamline their billing processes and focus on growing their business.

Shopify (Shopify Pay Installments)

Shopify Pay provides users with the option to pay for their goods in full at checkout or in installments for orders from $50 to $17,500. Customers can choose between four, twice-weekly, interest-free payments for orders from $50 to $999.99 or monthly payments from $150 to $17,500. Monthly installment payments come with interests from 10 to 36% APR.

Mobile Payments

Mobile payments are becoming increasingly popular worldwide, with clients using smartphones, tablets, and even smartwatches to carry out transactions from eCommerce platforms. As the saying goes, “necessity is the mother of invention,” and ever since the invention of the mobile phone, people have been trying to go full mobile.

ConclusionPayment gateways play a crucial role in the digital eCommerce landscape as they help to eliminate certain obstacles to online transactions by providing a reliable and secure means for customers to make payments for goods and services.

While the advantages of payment gateways are undisputed, the choice between an off-the-shelf or custom-made payment gateway system will ultimately hinge on the unique requirements of your business.

- 7 Easy Steps To Build Your Startup

- 7 Practical Tips to Build an MVP for a SaaS Startup

- A Non-Tech Founder Guide in Hiring Developers for a Startup

- Are you looking for the best way to launch your start-up idea in 2025? Start with an MVP!

- How to Build an MVP for a SaaS Startup

- Why Laravel is the Best PHP Framework for Startups?